Option A good: Investing instead debt recycling. Dedicate $100,000. Discover $4,000 of money. If the taxation requires 37%, you will be left having $dos,five-hundred income.

Alternative B: Purchasing with debt recycling cleanup. Lower $100,000 off personal debt (your non-allowable financial). Redraw $100,000 and purchase it. Found $4,000 of cash.

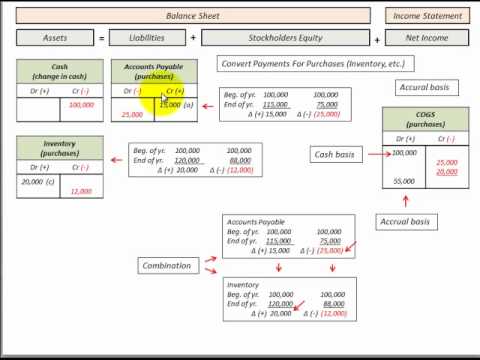

This time you could potentially claim $six,000 of great interest once the a taxation deduction (appeal to the $100,000). Anyone can claim a tax death of $dos,000 on your invested interest, which leads to a taxation refund of approximately $700 reimburse (from the 37% taxation speed).

Having each other possibilities you’ve got $five-hundred,000 away from financial obligation. You’ve paid down $six,000 interesting with the 12 months. You’ve spent $100,000. And you may you received $4,000 cash.

And you can good mortgage broker makes it possible to created the loans precisely to really make it simpler

Because of the debt recycling cleanup, the income tax condition alter off spending $step one,500 taxation, to getting a refund off $700. Full, that is an update out-of $2,2 hundred.

Today, I am unable to think of numerous ways so you can juice your own yields in the place of delivering much more risk, but loans recycling cleanup ranking very damn on top of the fresh details list.

You can score a taxation specialist to perform from the wide variety for the brand of condition. However, I am hoping so it demonstrates to you the potential pros (look for my complete guide for lots more).

Overall, a top interest rate mode there are many more income tax deals so you’re able to getting had. Incase your own taxation speed is higher than what I have quoted, its significantly more once again. If you was basically on the fence about debt recycling prior to, it might be value a close look.

Simply speaking, I am continued and work out my personal normal home loan repayments, towards our home and leasing functions, and in case discover spare cash readily available, I’ll purchase they.

All our loans was tax deductible, together with on our place of residence. You will find currently complete financial obligation recycling immediately following using another type of unusual method. I explained all that in this article.

Given every personal debt is actually allowable, purchasing it off actually extremely appealing to me personally today. Basically are seeking to Collinsville loans partial-retire otherwise log off work in a couple of years, after that paying off loans might be a whole lot more tempting.

In our very own version of circumstances away from currently are FI, maybe not compassionate in the financial obligation, and you may generating region-go out income, expenses benefits.

That being said, if the currency turned into tight otherwise we both planned to go travel and not carry out any paid back benefit this new near future, I’d at least contemplate eliminating the mortgage so you’re able to simplify our earnings and relieve expenditures.

Conclusions

Choosing whether to lower your own mortgage otherwise purchase happens to be a difficult decision than ever. In addition, once you learn some body who’d want to consider this post, excite share they with these people.

In the event the mortgage only will set you back your dos%, it’s easy to toss your money on the financial investments. But with an effective 6% interest rate, settling financial obligation becomes far more appealing in addition to profitable selection is not very clear.

My guidance (never share with ASIC): like a choice one aligns with your priorities, your very own wants, as well as your exposure endurance. Maybe it’s destroying the loan. Perchance you remain committed to spending. Or you have decided its a lot of fun to begin with loans recycling cleanup.

Mental situations aside, it is preferable whenever you find a technique and you will follow they. Once the while i stated, this new asked discounts and you can returns each alternative alter over time.

Flip flopping from 1 to another is likely only heading to bring about a sandwich-optimal consequences, with quite a few constant suspicion and you will choice weakness around if and when to button solutions again.