Increasing home values over the past while has caused a keen fascinating complication property owners have found by themselves with significantly more family guarantee.

Home equity ‘s the difference in your house’s worth and exactly how much you continue to are obligated to pay on the home loan. Such, in the event your house is well worth $300,000, and you owe $50,000 in your mortgage, you’ve got $250,000 from inside the security.

Anyone who is the owner of assets has many level of security. Perhaps the assets are purchased totally that have bucks or a home loan (paid off otherwise still investing), you’ve got security of your house. For those who get property having home financing, their down-payment ‘s the earliest equity you generate on your domestic. For that reason homeownership is considered a good investment otherwise wide range-building advantage.

How is actually Home Security Put?

There is absolutely no criteria to utilize your home’s guarantee anyway, nevertheless will likely be a helpful monetary choice for the individuals looking to achieve large goals. Family equity financing give a lowered interest rate and better financing amount than simply you would generally speaking score from a personal loan. It is because property collateral loan spends your house once the equity, reducing chance into financial.

When you’re there are other an approach to borrow cash, they often started at the increased rates. You could also use cash, however, wiping out your discounts or borrowing from the bank from your own funding profile can be cost to suit your upcoming.

Household Guarantee Line of credit (HELOC)

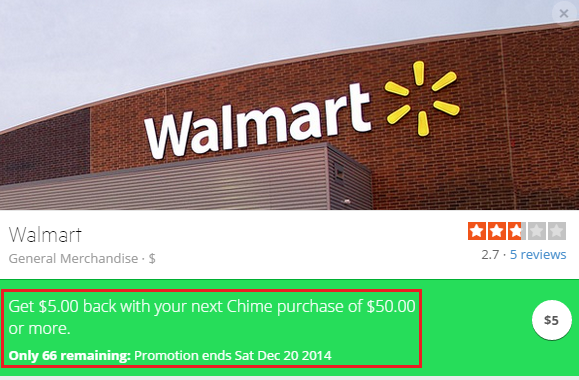

A line of credit works much like credit cards. Its a beneficial revolving personal https://paydayloanalabama.com/cusseta/ line of credit one lets you borrow as required. If you are planning for several expenses during a period of date, a good HELOC may greatest work for you.

The way it works: A good HELOC are divided into a couple phases. The original phase can be your mark months, if you possibly could use out of your line of credit whenever you need so you can. Paying off your debts during this period renews the credit readily available. The latest draw months is accompanied by a repayment period, where you are able to don’t mark out of your HELOC and can repay the very last equilibrium on the line of credit.

Bear in mind: HELOCs will often have couple if any closing costs, and this conserves currency initial. Keep in mind that these lines of credit normally have adjustable attention cost. Your own borrowing costs could increase if costs rise.

Household Security Loan

The way it works: A home equity mortgage functions same as a home loan or any other financing. You get the income upfront and you will pay back their loan’s prominent in addition to need for monthly installments.

Ideal for: Spending money on an individual larger expenses, such as for instance a home restoration otherwise debt consolidation. Since the an installment financing that always features a predetermined interest, a home collateral financing keeps predictable payments that make budgeting smoother.

Bear in mind: By taking out a property collateral financing if you’re still using out-of much of your mortgage, so it next mortgage may have a top interest rate than simply the first-mortgage.

Make use of Collateral to cover Home improvement Strategies

To carry on strengthening collateral of your property, home improvement programs one improve worth try an audio financing. High do it yourself systems, such as for example a kitchen redesign, in-laws room, accomplished loft or cellar, and other trendy enhancements can raise domestic worthy of.

- Kitchen: $ten,000-$50,000, average of $20,474

- Bathroom: $9,000-$20,000

- $cuatro,400 getting wood, $dos,800 to possess laminate

- Windows: $8,five-hundred having plastic, $20,000 to possess timber to possess ten windows and structures

- Roof: $20,000

- Additional exterior: $14,000

- Contractor will cost you: 10-15% of your own project’s total cost

If you’ve been trying to make condition to your residence in the place of breaking the lender, listed below are some these types of 7 Home improvement Strategies that’ll not Crack this new Financial.

Make use of your Guarantee to help you Consolidate Debt

In the event your objective will be to save your self as opposed to spend, making use of your family security to consolidate higher costs can help you reduce appeal and you may simplify monthly premiums. When merging loans, check out the interest of one’s obligations or bills to-be consolidated, the source of this financial obligation, and you may if the collateral may be worth the chance.

In the example of using house security to possess debt consolidation, youre with your family since the equity. This isn’t a matter you need to take carefully, particularly if the loans becoming consolidated is the consequence of mismanaged expenses otherwise budgeting.

Start-off Now

We’ll help you to make the techniques given that simpler and you will reasonable that one may. Listed below are some American Culture Borrowing Union’s competitive home guarantee options and you can easily implement on the internet. Call us any time which have issues.