Every day life is packed with shocks, and not always a great ones. When you find yourself in times for which you you need a massive amount of money to cover a big expense, upcoming deciding to tap into the guarantee of your home is feel a sensational option. One method to do that is through acquiring a house equity mortgage. On this page, we are going to go over the ins and outs of domestic equity loans, how they work, and exactly how you might qualify for one to.

What is actually property collateral loan?

Domestic collateral can be defined as the newest percentage of your home you have paid off your share regarding assets, rather than the loan providers. In most cases, family guarantee stimulates over time so you’re able to pay down your own home loan balance or incorporate value to your residence.

You have got could possibly get been aware of somebody taking out an additional home loan on the house because that is essentially just what a house security financing was. Its a loan which enables you to definitely borrow on the new property value your residence. From the Welch State Financial, we frequently pay attention to people wanted property guarantee mortgage in check to cover home improvements, scientific bills, or to shelter college tuition.

Home security finance are attractive different money because they’re normally available at down interest rates than simply credit cards otherwise individual loans. Loan providers feel at ease providing you with straight down pricing as they be aware that for those who prevent spending such money, capable foreclose on the house.

How do family security money really works?

Home guarantee loans work exactly the same way your financial performed whenever you initially purchased your home. The bucks regarding loan are paid during the a lump sum payment to you, enabling you to put it to use since you need in order to. Just after researching the bucks, you will begin making repaired, monthly obligations to pay off the mortgage.

Do you know the benefits of using home security fund? Exactly what are the disadvantages?

Family security masters are pretty straight forward and you can straight forward. He’s experts eg lower rates and additionally tax masters that enable that subtract financial focus for the family security money otherwise lines of credit.

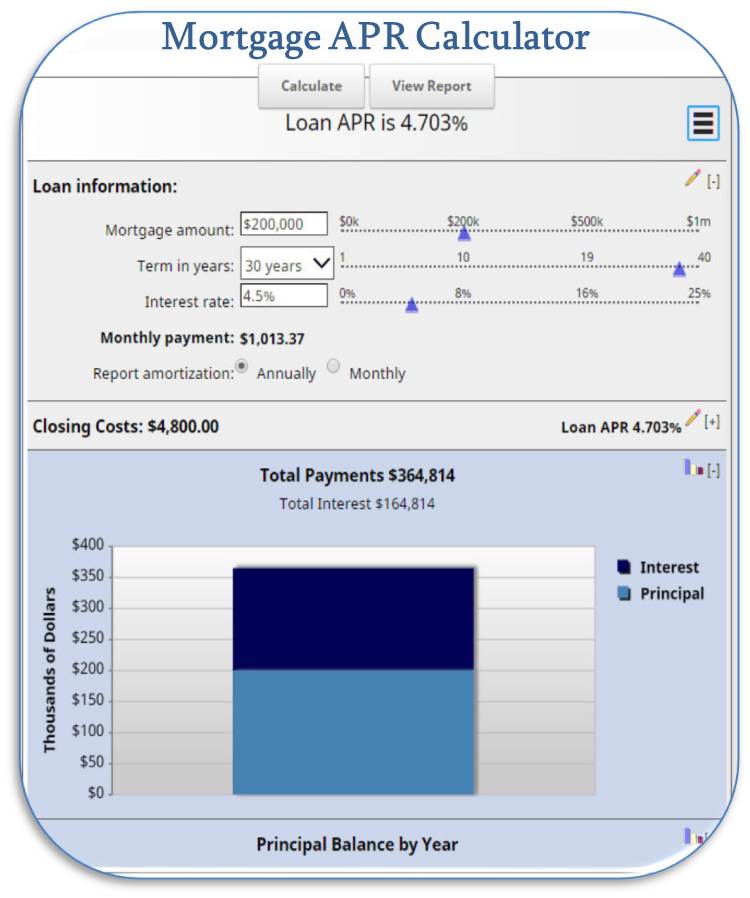

The new drawbacks to domestic security fund is the credit costs. Make sure you pay attention to the apr (APR), which has your own rate of interest including almost every other mortgage charges. A different sort of drawback in order to house guarantee money is the long-identity likelihood of losing your residence if you’re unable to make your payments and then foreclose on the domestic. Likewise a disadvantage to family guarantee fund is the capability to misuse the cash. It is important to stick to an economic bundle one guarantees you dont real time outside the function.

How will you make household guarantee?

Home equity is the difference between your own house’s economy value and your financial balance. With that said, there are ways for which you can increase your house security.

- Once you build your mortgage payments per month you slow down the a good balance on the mortgage, therefore strengthening house security. You’ll be able to generate extra mortgage dominating costs so you’re able to make guarantee shorter.

- After you make renovations, your enhance your property’s well worth which will raise your domestic equity. Whenever you are interested in learning more info on what home improvements raise your property’s well worth, go ahead and here are a few all of our weblog, 5 Do it yourself Ideas for added Selling Well worth.

- Whenever property value rises, your own guarantee goes up too!

How can i be eligible for a property equity mortgage?

Qualifying to have a property equity financing try a comparable strategy to qualifying for your first mortgage. If not think about much in regards to the procedure of purchasing your very first home, go ahead and check out all of our post entitled What to expect When purchasing The first Domestic. Your own lender will need files from you such proof of a job, including records of debts and you can property. They may together with request you to definitely possess:

- A couple of years’ worth of W-2s otherwise tax returns.

- Your own most recent shell out stub, which have 12 months-to-go out income detailed.

- Statements for everybody bank account and property.

- Financial obligation suggestions when it comes down to credit cards or other financing.

The lender’s job is to take all the info you’ve got provided them to check out simply how much collateral you may have of your house, which is the per cent of your house that you individual outright. This equity makes it possible to regulate how much money you can also be acquire. Most lenders merely enables you to obtain around 85% of your residence’s collateral.

- The degree of your home is well worth X the portion of household guarantee youre permitted to use simply how much you still owe in your household.

Instance, if for example the home is worthy of $two hundred,000 and you’re permitted to acquire doing 85% in your home security, however still have a beneficial $100,000 equilibrium on the mortgage.

- $3 hundred,000 X 0.85 = $170,000

Before applying for your financing, we highly recommend having rates in writing for how far you prefer so you’re able to use, and what you ought to use the money for. Merely borrow to you desire as you will be purchasing this financing more than an intensive-term.

What is the difference between a home collateral financing and a great domestic equity credit line?

Home equity loans and you will domestic collateral credit lines are perplexed. They are comparable possibilities because they both let you acquire resistant to the property value your home, but they are in fact totally different of each other.

A home collateral funds function such as conventional mortgages, while a house collateral personal line of credit really works instance a credit card. House security lines of credit generally speaking give you a payday loans online Washington time period of time you could draw collateral for your home, and just have changeable rates.

If you’re not yes that is good for you, the mortgage officers at Welch State Bank waiting to cam for your requirements. They’re able to help you come across that may be perfect for your circumstances.