To get a first home is a major challenge for many of us. But when you’re on their, it is actually more challenging.

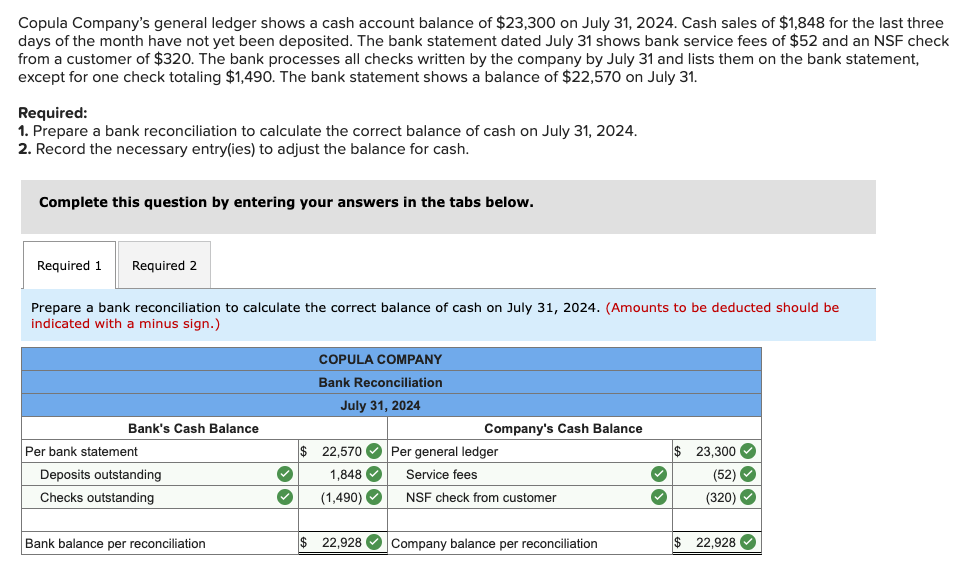

A recently-penned statement by the Building Communities Relationship (BSA) states two high income is actually increasingly needed seriously to afford mortgage repayments, and you will basic-time consumers are facing the fresh most difficult conditions to own 70 years.

Jess Waring-Hughes, good 32 12 months-dated team director, is preserving furiously to acquire on her individual and you may says here was absolutely nothing help for all those such things.

Its strange time for the youthfulness area and you may domestic again, claims Jess. It can make your regress so you can adolescent implies.

Boomerang age bracket

Inside the 1997, the best life style plan to possess an adult old anywhere between 18 and you can 34 had been in the a couple with children, with regards to the Resolution Foundation think tank. Now, it is managing your parents.

I do not have costs, We real time within my form, but really I’m still unable to pick some thing close to my personal family unit members and you may alongside might work.”

Nevertheless the BSA claims , while the home ownership one of many younger will continue to shrink, dependence to your parents will not hold on there. The lending company out of Mum and you will Father is frequently assisting to pay their grown up-right up youngsters’ dumps.

Half of basic-go out buyers within their 20s are receiving assistance of the common out of ?25,000 from their parents, according to Solution Basis.

Brand new BSA states which is usually currency which had set aside because of the old generation for their own security during the old-age.

Jess says she seated off together with her parents to draw right up a discount plan once she gone in the. Lisa, that has been protecting for seven decades, states this woman is in the middle of spreadsheets.

Being in a beneficial work is zero bad credit personal loans TX be certain that off advances, because development in wages has failed to maintain soaring family prices for over twenty years.

Add to the clear goes up in the price of renting, and you will constraints intent on how much individuals normally borrow.

The whole field assumes on you are in a couple of, if at all possible a leading-making partners, and this pushes anybody into the bringing caught for the dating which may not be good because of their mental health.

Whether or not saving having a deposit might have been a financial and rational load consistently, the brand new big ups – and you can unexpected downs – from financial cost within the last 20 days are in place of one thing seen for a few many years.

Two-seasons repaired business which used to have rates regarding lower than dos% hit as high as typically 6.86% a year ago, with regards to the financial guidance services Moneyfacts.

Despite falls subsequently, loan providers have been expanding costs into the current months . Moneyfacts states the common price is 5.87%.

These days it is even you are able to to browse the office getting Federal Analytics to see which areas of The united kingdomt and you will Wales certainly are the hardest hit of the ascending financial cost and you will rent .

Heart of one’s economy

If a tenant, a mortgage-holder, or someone who has paid their property loan, pair profit when possible earliest-big date customers was locked away from owning a home.

Construction is actually a switch part of the united kingdom discount since an effective whole. In the last week, the latest perception regarding a stagnant possessions markets on wide performance away from businesses from banking companies to shops might have been put bare.

Of many could see finance companies within the state, however their profits apply at their ability so you can give, otherwise – based assets – is reflected from the value of savers’ pension pots.

On the homeware merchandising industry, Dunelm has just told you seats conversion process continued to be “challenging”. When anyone do not circulate family, it buy fewer dining tables and you can chairs.

Jess contends you to definitely a person’s show just like the an occupant can be taken into consideration whenever obtaining a mortgage. Lisa says independence needs.

Prospective choice

They implies financial legislation are alleviated for them to provide a lot more to the people who do not want to expend a big put.

However, that might be questionable. Those guidelines had been fasten after the financial crisis out-of 2007-08 when many dispute financial credit by the banking companies is from manage.

For the January, Sir Howard Davies, who chair NatWest, advised it wasn’t “you to definitely hard” to acquire toward homes hierarchy. The guy later on rowed back on the their comments, stating he suggested usage of mortgages try smoother.