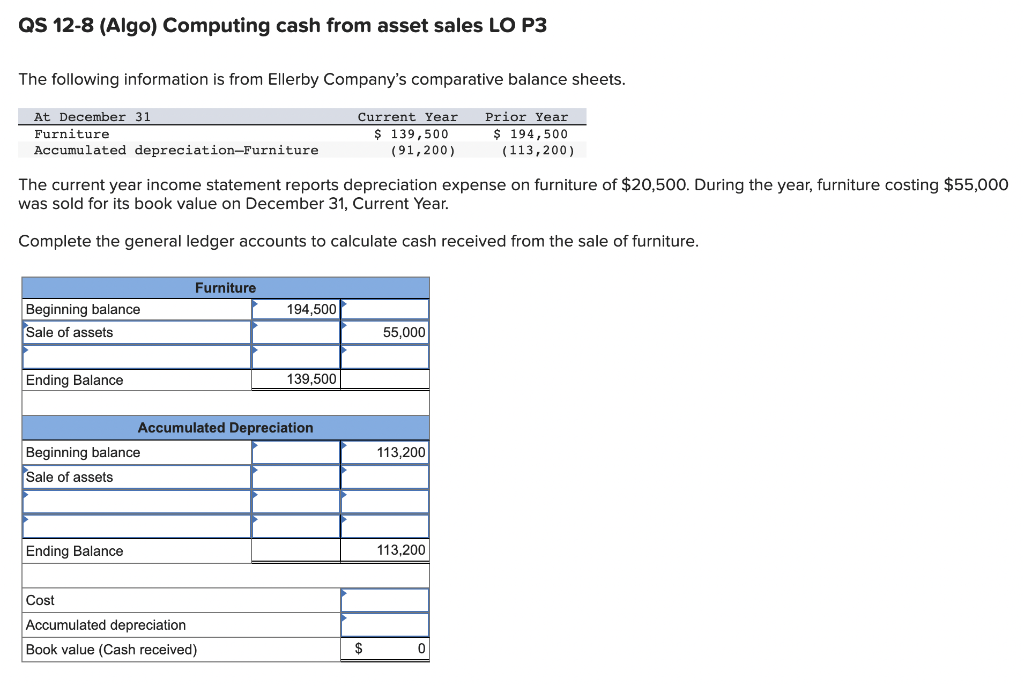

FHA and you will Virtual assistant fund remain because the private home loan apps permitting tips guide underwriting. Gustan Cho Lovers specializes in the brand new guide underwriting out of FHA and Va money. For individuals navigating the mortgage mortgage techniques amid Part thirteen Case of bankruptcy, guide underwriting is an expected both for Virtual assistant and you can FHA funds. Eligibility to possess an FHA and loans Petrey AL you will Virtual assistant financing was attainable following launch of Section thirteen Bankruptcy. Get Virtual assistant and you may FHA home loan just after chapter thirteen personal bankruptcy

In case the discharge away from Section thirteen Personal bankruptcy hasn’t been built having a minimum of two years, the newest file must undergo manual underwriting. The primary difference between instructions and you will automated underwriting system recognition lies throughout the simple fact that guidelines underwriting imposes all the way down hats for the debt-to-income ratio. A significant ratio of our own individuals, several-3rd, are presently engaged in a working Section thirteen Bankruptcy cost plan otherwise has recently completed the new Chapter 13 Personal bankruptcy techniques. Next point tend to outline the mortgage recommendations applicable throughout the Section 13 Bankruptcy proceeding repayment arrangements to possess FHA and Va fund.

Tips guide Underwriting As opposed to Automated Underwriting Program Acceptance

FHA and you may Virtual assistant finance is the personal loan apps enabling guide underwriting having mortgage loans. All FHA and Virtual assistant financing during the Chapter thirteen Case of bankruptcy payment months undergo manual underwriting. Furthermore, any FHA and you may Va financing which were released but i have maybe not reached a seasoning age of 2 years try susceptible to manual underwriting. As the guide underwriting advice to possess FHA and you will Va money try almost the same, it is noteworthy that lenders tend to be more versatile having Va finance compared to the FHA loans regarding guidelines underwriting procedure.

Virtual assistant and FHA Financing Just after Chapter thirteen Personal bankruptcy Qualifications Requirements

FHA, Virtual assistant, and you will Non-QM funds do not require a standing months following the release time out-of Part 13 Bankruptcy proceeding. Loan providers greet consumers making prompt money for the the month-to-month expenses post-bankruptcy filing. The latest impression lately money during and after Part 13 Bankruptcy proceeding may vary among lenders. Sometimes, one or two later costs because of extenuating affairs will most likely not fundamentally impede the deal. Nevertheless, later repayments blog post-case of bankruptcy discharge due to forgetting borrowing from the bank are likely to angle tall barriers when looking to financial degree and can even probably resulted in cancellation of one’s deal.

FHA and you will Virtual assistant DTI Assistance Throughout the Section thirteen Case of bankruptcy

New tips guide underwriting advice to have FHA and you may Virtual assistant financing directly reflect one another. Which border new guidelines underwriting advice into financial obligation-to-income proportion with the both FHA and Va funds. This new verification regarding rent, late fee, and you can compensating circumstances throughout Section 13 Bankruptcy getting FHA and you can Va loans in addition to showcase parallels. One Chapter thirteen Case of bankruptcy one to has never been through seasoning for a couple of ages following the discharge time means instructions underwriting. Prequalify to possess Virtual assistant and you may FHA mortgage after part thirteen bankruptcy proceeding

DTI Recommendations into the Tips guide Underwriting

In this post, we shall explore the idea of instructions underwriting. You will need to remember that Virtual assistant and you will FHA money, specifically those received inside Chapter thirteen Personal bankruptcy commission months, require instructions underwriting. Manual underwriting is exclusive so you’re able to FHA and you may Virtual assistant fund one of various financial programs. The fresh given debt-to-money proportion recommendations for FHA and you will Va loans was since follows: 31% to your side-avoid and you will 43% for the back-stop without the compensating products, 37% into front-avoid and you can 47% on back-prevent that have one to compensating factor, and you will forty% toward front-prevent and fifty% into straight back-prevent with two compensating circumstances.

FHA and Va Loan Qualification Criteria While in Chapter 13 Bankruptcy

- Homebuyers is also be eligible for a beneficial Va and FHA financing from inside the Section 13 Personal bankruptcy repayment bundle without Section 13 released