Ltd.Yes, IndiaP2P is actually a keen NBFC-P2P formal by the Set-aside Financial out-of India (RBI). IndiaP2P’s operations and offerings to lenders and borrowers was limited by RBI regulations.

It is critical to look at all charge prior to investing a common financing since these are deducted from your own financial support otherwise money

P2P means Fellow in order to Peer financing. They permits people to receive fund directly from rest in the place of brand new wedding of any mediator. It is another type of choice for borrowing from the bank money besides Banks. P2P credit are controlled from the Set aside Financial away from Asia.

Sure, all money was susceptible to income tax. Their attract income towards the IndiaP2P was regarded as almost every other income’ on your yearly output and you will taxed according to the prevailing earnings class. We’re going to express a profit declaration along with you each fiscal year. It’s also possible to have a look at your revenue in real time on your IndiaP2P membership dashboard.

Yes, you might invest only ?50,000 as your first financing. Passes up/re-capital can be made in any number. Restriction financing across the the P2P credit networks was capped from the ?50 lakhs.

We want your KYC and you may income tax character pointers depending on rules. Details of considerably more details gathered can be seen within Privacy Coverage. Take note that people do not display your details which have people businesses obtainable purposes.

IndiaP2P house windows and you will rates individuals having fun with all of our borrowing-formula because the laid out right here (IndiaP2P Borrowing from the bank Rules) to make sure their creditworthiness and you can determine chance prospective. Additionally, most borrowers are affirmed privately because of the our team. While the an investor lender, you will see and you will filter individuals base certain conditions. Typical financing violation types sought for from the consumers start around ?30,000 to help you ?100,000.

330 BC Which prejudice toward more-respecting possessions and you can things (or investment) i already very own is known as brand new endowment bias’ or the endowment impact since coined by the economist Richard Thaler. I usually worthy of something we individual more frequently with the membership to the fact that i invested some time and our very own focus from inside the putting some conclusion to have them. And additionally, given that people, brand new distress away from dropping some thing outweighs the fresh satisfaction regarding searching one thing similar something which wouldn’t bother a truly mental real human but up coming that is. This new endowment prejudice is almost an integral part of human nature having high repercussions about how i real time while having the way we browse within currency and you may wealth.

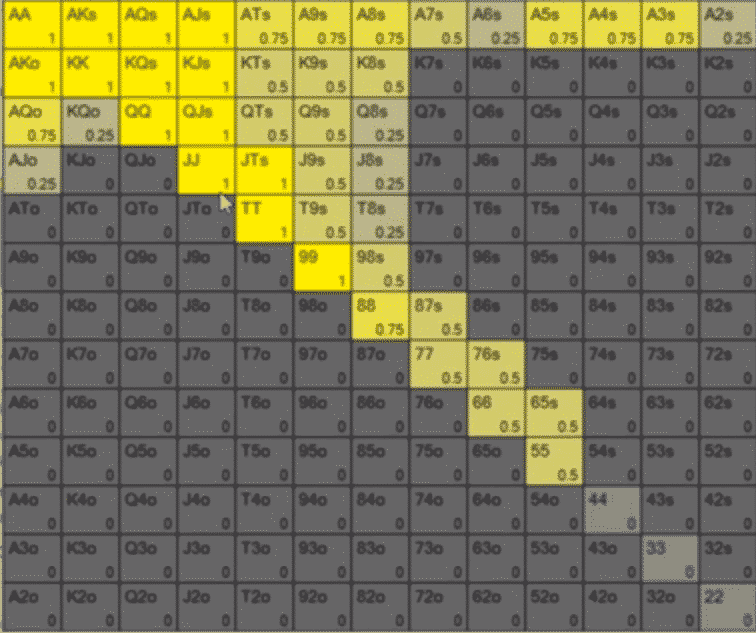

Eligible borrowers try ranked anywhere between A great and you may F basis said credit policy

The new rule out-of 72 is a flash laws in order to easily estimate how many many years it takes for the money to help you double for a given rate off come back. Such as: Should your Repaired Dumps is actually purchasing a profit out-of cuatro.5%. It will require 72/4.5 = sixteen many years for your money so you’re able to twice. Which have IndiaP2P, you can earn as much as 16%. And therefore increasing your profit = cuatro.five years.

2% including other additional costs can be appropriate. The fresh new show out of a common funds is commonly mentioned through several metrics named leader and you may beta. Let us begin by leader: Leader methods how good otherwise poorly the fresh new fund performed in contrast having a list. Just remember that , shared financing is actually thematic – will be a market, sized people an such like. So you can imagine alpha we must be aware of the nearest directory, let’s say for a finance you to invests within the higher businesses, BSE100 directory is generally suitable. What fund executives try to achieve are an optimistic leader we.e. deliver deeper efficiency than the list although not, negative alphas are a real possibility. Simultaneously, beta, is about volatility we.age. new pros and cons in rates so because of this your revenue. When your mutual money is much more erratic compared to the relative list this have a leading beta (>1) and you can reasonable beta (