- Habit Elements

- Swindle otherwise Specifics-Inside the Lending

Whenever creditors build financing to people, he is required by the way it is inside the Financing Work (TILA) to make sure written disclosures from the very important borrowing from the bank terminology. TILA and imposes adverts standards to the loan providers. These conditions were created to guard individuals from unfair and you can predatory financing means.

Funds Safeguarded Less than TILA

- Automobile financing

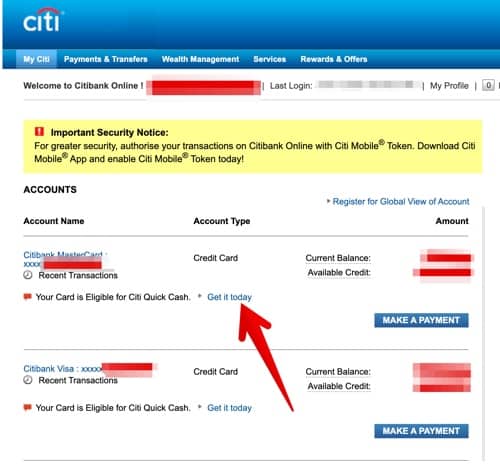

- Handmade cards

- Household security funds

- Domestic collateral personal lines of credit

- Mortgage loans

Exactly how TILA Work

Ahead of TILA’s passing, loan providers you will definitely obscure loan words like interest levels and you will financing charge since zero fundamental disclosure format lived. Differences in just what suggestions are listed-and just how it had been indexed-caused it to be difficult for people evaluate financing terminology and you may discover the true cost of credit.

Along with standardizing borrowing name disclosures, TILA might have been lengthened throughout the years so you’re able to impose a variety off standards and you may restrictions to the credit situations.

- User defenses up against wrong and you can unjust credit billing and you can bank card practices

- Consumer rescission liberties (options to terminate loans within this specific big date restrictions)

TILA Amendments

The financing Card Liability Obligations and you will Revelation (CARD) Operate out-of 2009 cities constraints with the mastercard rate of interest grows, restricts charges, forbids twice-duration recharging, gets cardholders longer and then make repayments, and you can raises regulations for less than-21 people to open up a credit card.

The Dodd-Frank Wall structure Highway Reform and User Shelter Operate regarding 2010 amended TILA also, including bans into mandatory arbitration, waivers off individual legal rights, and ability-to-pay-off criteria to own mortgages, among others. Dodd-Frank plus directed TILA rulemaking power towards Consumer Financial Shelter Agency (CFPB). Given that transfer away from authority, CFPB made dozens of TILA code transform.

Credit Act and Dodd-Honest FILA amendments have been preceded from the 1994 Home ownership and Security Security Operate (HOEPA), the fresh new 1988 Household Collateral Financing User Defense Work (HELPA), the latest 1988 Fair Borrowing and you will Credit card Revelation Act, plus the 1975 Reasonable Borrowing Charging you Operate (FCBA).

TILA Individual Security Rules

Lenders need to disclose to help you consumers, from inside the clear and simple code, details about loan words together with qualities they give. This article is furnished into the a good TILA revelation report you to definitely facts:

A beneficial TILA disclosure means, that also lists how many repayments, the latest payment, later charge, prepayment charge, and other extremely important terminology-for instance the proper away from recission for the majority mortgage transactions-is given a recommended borrowing/mortgage deal.

Even after a borrower cues financing contract that creates an effective judge cost obligations, they could exercise suitable or rescission for house guarantee funds, household equity lines of credit, and you may mortgage refinances (in the event that refinancing is by using a loan provider except that the modern lender) and you will terminate the mortgage unconditionally inside step three working days of one’s purchase.

TILA Administration and you may Individual Legal actions

The user Financial Coverage Bureau (CFPB) has administration expert along the TILA, nevertheless the legislation also offers a private proper out of action you to lets users to document legal actions, each other individual and you can category steps, against a collector. TILA imposes strict accountability with the creditors, which means that they’re assessed currency damage when it comes down to admission, irrespective of their intent.

According to FDIC, for the 2022, TILA infringements was basically the absolute most appear to quoted user regulatory violations from the banks. Total, finance companies committed almost five-hundred TILA abuses in the 2022, symbolizing thirty-five% of all of the cited statutory violations.

TRAC Account, a non-partisan lookup team in the Syracuse University, cards you to definitely functions can bring insights into the financing lawsuits below perhaps not precisely the Realities from inside Delta personal loans the Financing Act, but in addition the Reasonable Credit scoring Operate, the new Fair Commercial collection agency Operate, and also the Cellphone Individual Security Operate. Suits up against finance companies or any other financial people, such as those resource home loans and you may automobile sales or people delivering scientific properties, may raise knowledge in credit matters.

Milberg’s Specifics-When you look at the Lending Behavior Classification lawyer depict individuals wronged because of the loan providers and creditors with violated consumer defense statutes established because of the TILA.