However, having fun with a physical cards still demands pulling-out their purse and you may charge card. That with a cellular purse alternatively, you could potentially avoid touching one thing in addition to their cell phone. If you’ve got an excellent Samsung cellular telephone, you’ll should create Samsung Spend. Initially you have made been for the app, you’ll need do a new PIN. Up coming follow the recommendations to incorporate borrowing from the bank and you will debit cards to help you Samsung Spend. Even after getting belonging to parent team PayPal, Venmo stands out thanks to their dominance because the a fellow-to-fellow mobile fee software.

Online casino no deposit bonus 30 free spins: Perfect for Online shopping

They spends biometric testing tech named Deal with ID otherwise Contact ID, or you can fool around with a passcode to gain access to the brand new bag. You can add one debit or bank card along with Fruit Dollars, boarding seats, feel entry, gift notes and for the bag. Fruit Spend are extensively accepted at the shops and you may dinner in the industry. Although not, in addition to contactless money, mobile percentage software can also be ideal for giving currency to help you anyone you are aware, such as family members otherwise members of the family, otherwise investing investors in person. Samsung Pay supports Charge, Bank card otherwise Western Show borrowing and you will debit cards granted from the more than step 1,one hundred thousand banks and you may borrowing from the bank unions.

Can i create contactless costs on my cellular phone?

- However, if you are mobile out of a connected bank account doesn’t incur a great fees, with a fast Import of a connected debit cards, there’s a move commission applied.

- You can store several notes on the mobile phone at the same time, so you might prefer other cards for different sales.

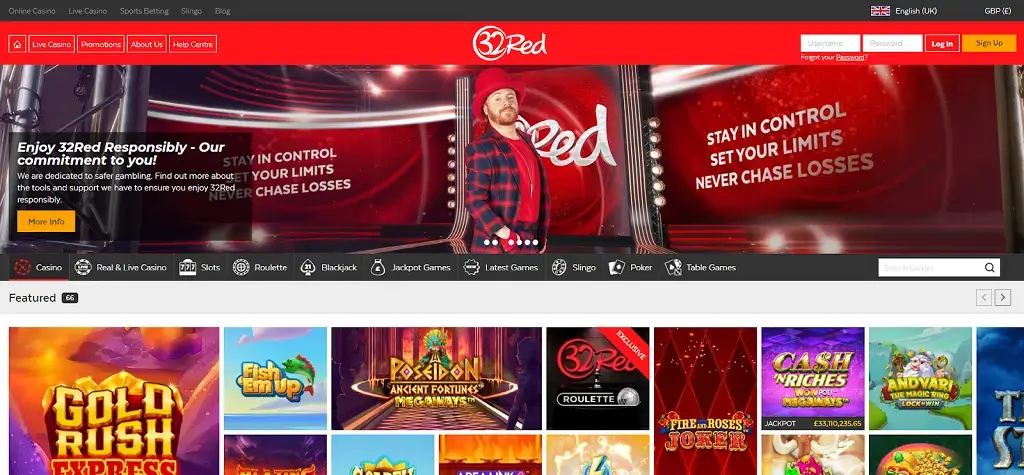

- And, keep in mind that the casinos we advice play with verified random count generators, and therefore all the spin of one’s reels or change away from the brand new cards is very haphazard.

- That’s as to the reasons investing your own credit card bill punctually consistently is actually the way to create borrowing from the bank and you can replace your get.

- Profiles can also without difficulty send cash to each other via a keen iMessage, or by inquiring Siri, the newest electronic assistant.

- And there’s no reason to dig in the bag for the wallet during the checkout stop—you can simply faucet your own cellular telephone to spend.

Some mobile percentage apps, such Bucks App and you can PayPal, is standalone packages; other people try cooked to the other functions. Such, Fruit Pay’s inside the-shop costs are designed for the Handbag app, and individual-to-people payments takes place within the online casino no deposit bonus 30 free spins Texts application. Such better, checked cellular applications enable you to build contactless payments, lend currency, or shop on line without difficulty. Google Pay works with most major bank card giving banks and you will borrowing from the bank unions, as well as American Show, Financial from America, Barclays, Money You to definitely, Pursue, Citi and discover. Although not, the brand new electronic wallet may not be suitable for specific co-labeled handmade cards, organization playing cards and you will industrial playing cards. For individuals who’re also searching for using faucet-to-shell out on the mobile phone, discuss the choices for a digital bag now and you can connect their Financing One to charge card to begin with.

That it mobile credit card processor features numerous customer service channels. To the its web site, it’s an excellent searchable knowledgebase, a site, and you may a good chatbot you to definitely responses questions about ideas on how to set up a free account, the brand new records that’s needed is, prices, as well as how this service membership functions. It can also respond to popular inquiries you to SumUp resellers has on the its account, credit reader and you can payouts. They will require a few working days to own Shopify Costs to help you import your own processed fund in the organization checking account, that’s for the a level along with other better charge card running companies. If you would like to get your own money weekly otherwise month-to-month, you could potentially create a payment agenda.

Neither Financial out of The usa nor Zelle offers pick protection for repayments made out of Zelle. Excite get rid of Zelle repayments for example cash, once you send the cash, you’re unlikely to have it back – such, you don’t receive the items you paid for using Zelle and/or goods gotten is not as discussed. In the wide world of percentage software, Cash Software (Android, iOS) are a robust competitor, seeking to somewhat help the method most of us posting currency to help you each other. Maybe the greatest element is the fact that the people your’re also using doesn’t you would like their own Bucks App account—you need to use the fresh software to expend people whose email you realize.

Finest Credit cards out of 2024

Knowing how to use your own mastercard in your cell phone is also make looking far more convenient and keep you from being required to build connection with the fresh card terminal. Rather than being forced to look a charge card out of your purse, you can just unlock your cellular phone and you may hold on a minute along the contactless mastercard audience. Tap to expend is a straightforward and safer solution to create in-individual purchases, and you may contactless money can be more safer than just having fun with an elementary charge card viewer. And make mobile money is easier than ever before — which is probably why much more about People in the us is actually embracing mobile purses to have informal transactions. To spend together with your mobile phone, you normally need to take a digital purse or fee app which is regarding a card otherwise family savings. After you’ve create your own payment means, you only keep your cellular telephone close to the payment critical, examine an excellent QR password, otherwise faucet to expend doing the transaction.

- If you make a hands-on charge when Auto Charge is let then guidelines cost will become the brand new standard function.

- An each-line autopay discount, in particular, you will surpass the financing credit perks you would secure or even the phone cellular telephone publicity you might snag.

- For this reason it’s vital that you recognize how software-dependent commission programs functions and how they are able to actually cover your currency even better than a cards.

- A very clear understanding of your online business means will assist narrow down the choices and make certain you choose a great chip one aligns with your own functions.

- They’lso are a while quicker than simply swipe costs, and far shorter than simply EMV processor chip payments, which are slow.

If you decide afterwards you want to improve to some other payment approach, then you certainly’lso are completely free to take action. As an example, let’s state you have four cellular telephone lines to your a T-Cellular package, which may provide a great $twenty-five autopay disregard. Even if you play with credit cards you to brings in dos% cash back to your all requests, you’d need to purchase $step 1,250 30 days to earn $25 inside the cash back. There aren’t any T-Cellular plans that come alongside costing anywhere near this much, so in cases like this, missing the financing cards and you can going for the new autopay disregard are possibly the correct enjoy. Yet not, it’s usually a good idea to review your mobile merchant’s conditions and terms, since their cost can differ based on how you decide to spend.

Blue Dollars Popular Credit of American Share

If swiping a card or “dipping” a good processor chip, it’s tough not to touch societal surfaces whenever paying. State your own set of family went to an appreciate bistro for a birthday celebration. Of numerous commission software and you may features enable you to split a payment—simply go into the full number and all the brand new contacts which need to chip in the. Naturally, they need to be accompanied the fresh percentage services you might be playing with. The assistance will vary in the way far they enable you to shell out, nevertheless they basically enhance your limit greeting fee with more utilize.

New iphone 4 16 show expose

We deliver prompt condition, fascinating expertise, and personal promotions to your email. Just after joined, you can be request £step 1 because of the calling 282 clear of your mobile. One other associate can get a made price text message so you can prove your’ve expected £step 1 and it will getting debited of the better-up credit. Ashley Barnett might have been creating and you may editing personal money content to possess the online since the 2008. Ahead of editing for United states of america Today Blueprint, she is the message Director to have an international mass media organization leading the content to their collection away from individual finance web sites.