Coming up with an advance payment shall be problematic, which is why many homebuyers explore advance payment merchandise and then make event the large share much easier. The most used origin for a deposit current is inspired by mothers or friends, and you will deposit gift ideas can sometimes be the difference between somebody to be able to buy a house or otherwise not.

However, with these financial gift ideas to suit your deposit isn’t as simple as depositing them in your checking account. Your lender need to learn where in fact the funds originated and can require specific items of documents to that prevent.

Then we shall define tips one another provide and you can receive a down percentage gift, and who will leave you a down-payment current throughout the first place.

Underwriting is the process wherein your financial product reviews your income, credit history, and you can assets to choose whether or not to lend you currency.

One of several stages in looking at their assets are examining in order to guarantee that new places on the membership are indeed property – maybe not financing. The brand new underwriter might possibly be shopping for people higher unusual places (as opposed to typical dumps, like your salary), meaning that people merchandise from friends and family you bundle to use for your deposit tend to instantly improve a yellow flag.

This task is important to ensure that you have enough money for pay back your loan. Should you have to obtain a personal loan while making your own down payment, you might not be able to outlay cash one another back when enough time showed up.

To show your deposits on your own membership are gifts and you will not funds, you will have to provide the underwriter that have a present letter. Read on to know just what that it entails.

Three tips are essential once you accept a downpayment gift, regardless of the type of mortgage you are obtaining. Pursue these procedures for each and every advance payment gift obtain on their own – dont mix multiple merchandise in one single process.

The initial step is always to have the gifter of funds generate a deposit current letter. The brand new current letter ought to include:

- The fresh new donor’s label, phone number, and you will target

- New donor’s relationship to the loan candidate

- The brand new big date about what the funds had been transmitted

- The dollars level of the fresh new provide

- The street address of the property are ordered

- An announcement regarding donor showing the loans is good gift and you may cost is not requested

- Signatures and you may times out of all activities

So it starts with the latest gifter documenting where the financing originated in in the first place. Like, if for example the gifter sells individual stock to generate the latest provide currency, they need to file the deals of inventory plus the transfer of funds from the broker membership in their lender membership.

Then your gifter should develop a check towards the homebuyer. Ensure that the dollar amount for the have a look at matches the fresh new dollars number specified regarding the current letter exactly. Build a couple of photocopies of your see – you to definitely on the gifter’s ideas and one on homebuyer so you’re able to reveal the new underwriter.

Note: Creating a is recommended more wires finance because it’s better to document and you can song, simplifying this new opinion techniques on underwriter.

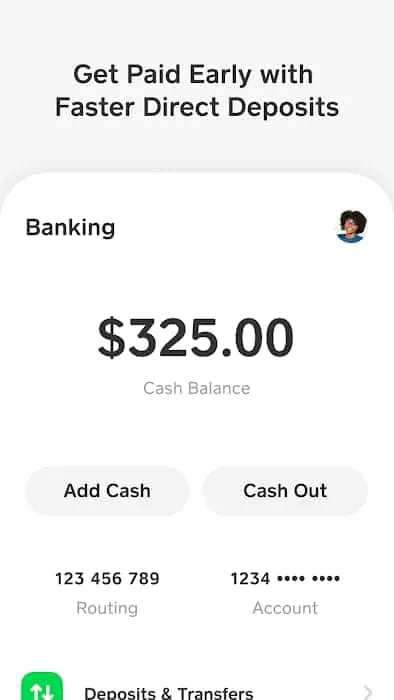

Once you’ve this new take a look at able and reported, visit your lender in order to deposit it inside the-people. Dont deposit the newest evaluate having fun with an application or Automatic teller machine servers.

Ensure that the family savings you put new current funds into the is similar membership of which you’ll be able to mark each one of your money at closing. Taking money from multiple profile in the closure makes new documents loans in Steele more challenging to suit your lender.

Score a receipt to your deposit. This new dollar number towards the receipt will be satisfy the dollars number given on your advance payment current letter just, thus usually do not build several dumps in identical deal. The lending company will most likely reject your downpayment gift page and you can the fresh new relevant fund if the numbers do not perfectly matches.

Advice to your who will offer you a down payment present differ depending on the kind of financing you might be applying for.

Old-fashioned Fund

The latest deposit current generally need come from members of the family whenever you are making an application for a normal loan as a result of Federal national mortgage association or Freddie Mac. To possess financial aim, next everyone is experienced members of the family:

- Mate

- Bride

FHA Financing

Federal Construction Management (FHA) finance create all of the household members mentioned above (and upcoming when you look at the-laws) to produce deposit gift suggestions, with the exception of nieces, nephews, and you will cousins.

However, in addition to relatives, the new FHA do allow close friends having an obvious demand for your lifetime to provide advance payment gifts. This might is nieces, nephews, and you will cousins plus former partners.

USDA and Va Loans

The usa Company from Farming (USDA) and you can Service out-of Experts Factors (VA) ensure it is deposit gift ideas regarding anyone when they aren’t an interested party, definition they can’t feel directly otherwise ultimately involved in the genuine property transaction. Curious events is, but they are not restricted to help you, the:

The fresh new down-payment current process is not excessively complicated, although it does should be accompanied exactly with the intention that your own bank to just accept the cash. A error you’ll imply rejection of one’s downpayment current financing and you can precious time set in the mortgage software processes.

With the intention that everything you goes best initially, manage a mortgage broker you never know the brand new the inner workings away from down-payment merchandise. Seattle Mortgage Planners try willing to answer your entire inquiries and you can walk you through the entire procedure. Agenda an appointment right now to get started!