- Tools and you will rates. It’s not hard to overlook them, however you might have to blow set-up costs to really get your brand new home connected to tools such as energy, internet and cellular telephone. you will need to plan for constant will cost you including council prices, power and drinking water, and the body corporate fees if you’re to buy an effective townhouse or device.

- Other relocating will cost you don’t forget the price of renovations, repairs or decoration, chairs and you can moving your personal property into your brand new home.

After you sound right all of the can cost you possible deal with because a good result of buying your new house, you’ll realise that you should kepted thousands of dollars from your funds to ensure that you are not caught short.

Choosing home financing

The next phase is to determine which kind of mortgage your need to apply for. There are facts to take into account:

How long would you like to obtain to possess?

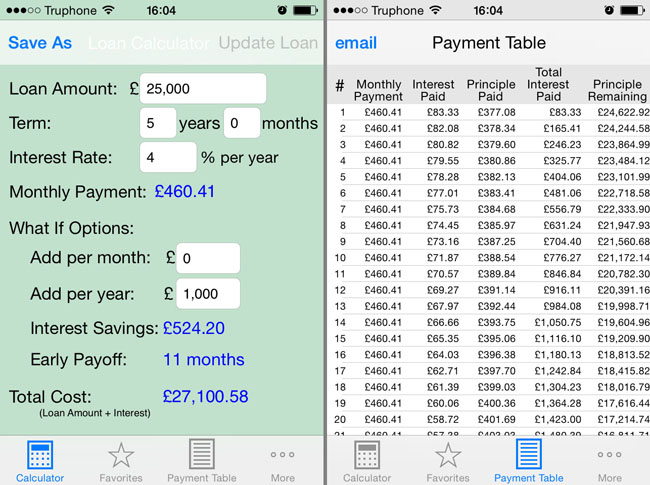

When you find yourself credit to have including several years means you can build lower monthly money, moreover it means you will be purchasing way more inside complete, since your equilibrium will certainly reduce way more much slower, and you may pay notice to have much longer. If you can, decide for a smaller financing title in order to potentially help save many away from bucks.

What sort of appeal build would you like?

- Repaired pricing supply the security out of once you understand how much cash you will be paying for an agreed several months and cover you against goes up within the interest rates. The drawback regarding fixed focus would be the fact regardless if costs slide, your instalments will remain a similar while probably won’t have the liberty and then make a lot more payments to reduce your debts more quickly.

- Drifting costs usually incorporate the legal right to pay back the mortgage very early and they are tend to about offset accounts or redraw organization, so you’re able to minimise the interest possible pay while you are nonetheless that have use of cash if you need it. The top disadvantage would be the fact you’ll be met with goes up during the interest levels, that enjoys a giant impact on the month-to-month repayments.

- Some loan providers give split’ or combination’ mortgage loans in which interest is restricted to the an element of the financial and drifting on the other side providing you with a number of the pros and cons out-of each other products.

How can you want to design your house loan?

Generally, lenders during the The fresh new Zealand is planned because table’ finance, in which you’ll create normal, equivalent month-to-month costs. Initial, the majority of for every single payment might be interest, but throughout the years you’ll be able to pay-off pay day loans Thomaston Alabama much more about from your loan equilibrium with each cost.

- a reducing, otherwise apartment financing, where you spend a predetermined amount off of the dominating of your own financing every month, together with an interest payment, that’ll cost so much more beforehand but reduce the equilibrium so much more easily which means you pay quicker notice full.

- a good rotating borrowing from the bank loan, for which you enjoys an agreed credit limit (the same as an overdraft restriction) therefore make use of home loan membership because the a transaction account (i.elizabeth. investing on your own earnings and ultizing it to invest your expense). Possible shell out focus, determined each and every day, for the real harmony of your account, along with your credit limit wil dramatically reduce every month.

How much cash deposit are you experiencing saved?

To track down a primary home loan into the The fresh new Zealand you could expect to you need a deposit no less than 20% if you don’t qualify for a primary Home loan or even the most other types of guidelines outlined over.

If you don’t meet with the Very first Mortgage eligibility requirements and you will you’ve got below 20% stored you might still have the ability to make an application for a minimal-deposit loan, however these will likely be difficult to secure while the lenders are constrained by the regulators constraints to the high-LVR’ financing.