Sure, HUD 232 funds wanted consumers to blow an MIP (Financial Advanced), because the both a-one-some time an annual costs. MIP of these fund has a 1% single MIP investigations, payable in the closing, and an effective 0.65% annual MIP charges, paid back yearly.

- Would you like Mortgage Insurance for a HUD 232 Mortgage?

- What exactly is MIP?

- For additional info on FHA 232 money, fill out the proper execution less than to speak to help you an excellent HUD/FHA financing specialist.

- Relevant Questions

- Score Financing

What exactly is an excellent HUD 232 loan?

A beneficial HUD 232 mortgage is that loan covered of the U.S. Service away from Housing and you may Urban Advancement (HUD) which is used to finance the development and you can rehabilitation off organization getting earlier anybody requiring healthcare and other a lot of time-identity proper care, and also the get and you may refinancing off senior-centered health care characteristics. HUD-stored financing try loans which might be kept by the HUD and generally are used in relation to FHA 232 funding. For additional info on HUD 232 money, delight fill out the design on the web site to communicate with an excellent HUD/FHA loan specialist.

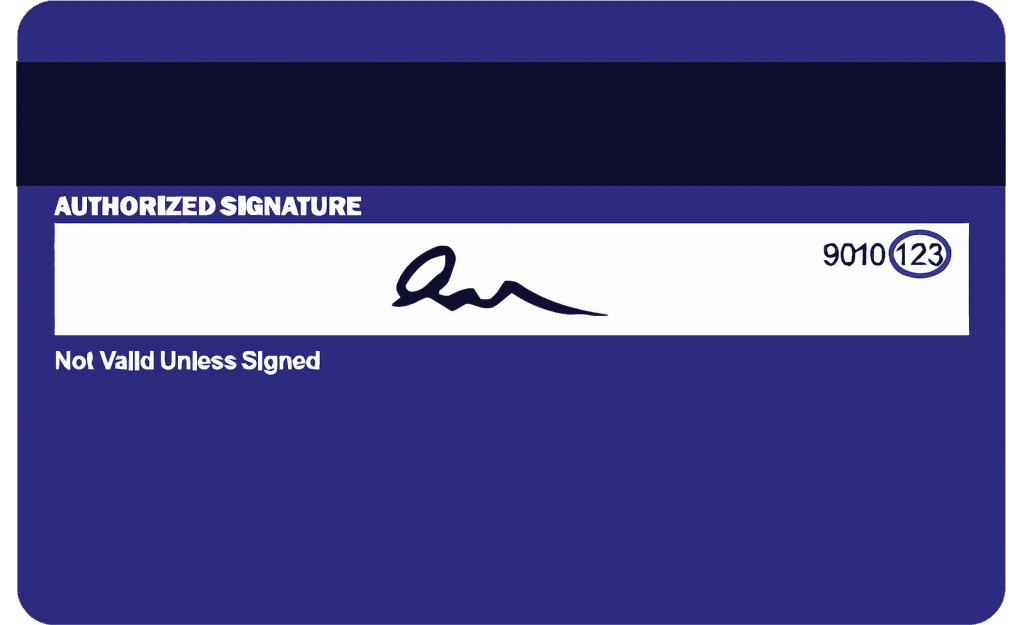

What’s home loan insurance rates (MIP)?

Mortgage Top (MIP) was an annual payment to your a great HUD financial, paid back during the closure, for each and every season regarding framework, and annually. Having HUD 223(f) funds, MIP try twenty-five base points having qualities using a green MIP Avoidance, 65 foundation factors to own field price functions, 45 basis things having Area 8 otherwise the brand new money LIHTC qualities, and you may 70 base factors to own Section 220 urban restoration methods you to are not Point 8 otherwise LIHTC. For HUD 232 fund, MIP is actually 1% of your amount borrowed (due within closure) and 0.65% per year (escrowed month-to-month).

MIP is a vital attention when considering HUD funds. It is a kind of insurance you to definitely handles the lender regarding loss you to definitely can be found when a borrower non-payments. When you find yourself upfront and you will yearly MIPs is actually costs you should check whenever examining the loan possibilities, it is possible to dump all of them – and even in place of a decrease, HUD financing are nevertheless generally a lot less high priced than other designs off multifamily debt, actually Fannie mae and you will Freddie Mac computer money.

Was HUD 232 finance necessary to enjoys mortgage insurance (MIP)?

Yes, HUD 232 finance require individuals to expend home financing Insurance premium (MIP), as the one another a single-time and a yearly debts. MIP for these loans has a-1% single MIP investigations, payable in the closure, and you may good 0.65% (65 base facts) yearly MIP charges, repaid each year getting market rate properties. While doing so, HUD allows the following customizations:

- 0.45% (45 foundation affairs) getting Part 8 or new currency LIHTC characteristics

- 0.70% (70 basis products) having Section 220 urban revival methods (non-Point 8 and you can low-LIHTC ideas)

An enthusiastic FHA application commission away from 0.30% of your entire amount borrowed is additionally requisite, and additionally an enthusiastic FHA assessment percentage off 0.50% of your loan amount (no matter if this really is financed towards financing equilibrium).

Exactly what are the benefits associated with a good HUD 232 mortgage?

- HUD 232 refinancing from numerous characteristics can also be considerably increase earnings, probably giving developers the capital to find otherwise construct the fresh possessions

- HUD fixed-price financing allows high organizations so you’re able to stabilize costs and work out appropriate financial forecasts well for the future

Do you know the requirements to own an excellent HUD 232 financing?

To help you sign up for a beneficial HUD 232 or HUD (f) financing, a debtor must normally have feel efficiently operating no less than one establishment of the same type which they decide to create or get. Additionally, a debtor also needs to end up being prepared as a single asset, special-purpose organization (SPE). Eligible consumers may either become a concerning-cash otherwise a non-money entity.

In order to be eligible for HUD 232 capital, services need to meet a variety of qualification criteria, in addition to providing continuing care, getting rightly subscribed, and having no less than 20 people.

Lower than try an outline away from insurance standards to have HUD 232 resource. HUD’s intricate standards having insurance coverage with the www.availableloan.net/installment-loans-nc/hamilton/ Point 232 loans can be found into the Chapter 14 of your Healthcare Financial Insurance policies Program Manual (4232.1).