It will take very long to obtain the right household to own you, therefore means multiple visits regarding urban area to gain access to individuals societies and you will accommodations. Whenever you are looking to buy a house which have home financing, you’re going to have to read a special round out-of conferences to your bank, that’ll include several layers out of paperwork and files. Henceforth, Domestic First Finance company features digital options in the home mortgage classification so you’re able to express the procedure of making an application for a good mortgage.

Household First Monetary institution habits Display Financing to help make the loan techniques brief and straightforward. It’s easy to make an application for a mortgage on the internet on at any time and you can out of one place.

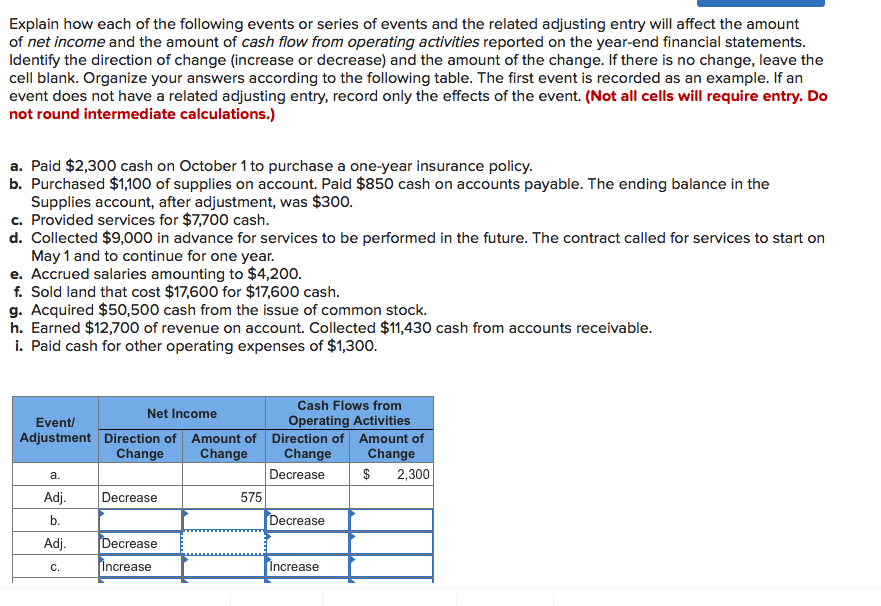

Once you fill in the application online, you’ll receive prompt approval. HomeFirst enables you to get that loan sanction in only 5 easy steps. This service membership offers an initial Sanction Letter, about what you can receive a loan.

Step one: Be sure your account | Step two: Discuss your income information | Step three: Define your house facts | Step 4: Provide your email address | Step 5: Score a loan render

Features of HomeFirst Home loan

- It could be approved in only a few clicks.

- At this time from loan recognition, no files are expected.

- Finest corporates can enjoy an alternate operating contract.

- The transaction is actually paperless, and also the entire house application for the loan process is done online.

Eligibility having Mortgage

Credit history/Credit history: Generally, lenders always give in order to people with credit scores of 750 or a lot more than. For example loan candidates features a much better likelihood of taking house loans with reduced rates of interest.

Ages of brand new Candidate: Basically, a decreased ages to try to get home financing is actually 18 decades https://simplycashadvance.net/payday-loans-nv/, together with restriction ages at the time of financing readiness try 70 many years. The fresh repay go out is typically up to 30 years, with many different loan providers capping age advancing years once the limit years maximum.

Money and you can a job: A top money implies a greater ability to pay-off a loan, implying less chance with the lender. For their high-earnings predictability, salaried staff routinely have a far greater likelihood of obtaining home loans in the all the way down rates.

Installment Strength: Finance companies and HFCs will approve mortgage loans so you can people whose whole EMI union, such as the suggested home loan, doesn’t surpass fifty% of their overall earnings. Just like the opting for an extended mortgage several months decreases the house financing EMI, persons which have decreased loan qualifications normally most readily useful its condition because of the choosing a longer tenure.

Property: Whenever deciding household mortgage eligibility, lenders consider the property’s health, strengthening attributes, and you may ount that may be given toward property. The most a loan provider can offer into a casing loan dont exceed 90 percent of one’s property’s worth, according to RBI direction.

Data Requisite

To acquire a home loan, a candidate ought to provide an abundance of data creating its KYC, the brand new antecedents of the property they attempt to get, its money record, and the like, according to and this customer group it belong to (salaried/professional/businessman/NRI).

The newest records requisite differs from you to bank to the next. The following are some of the most normal data files you’ll need for a mortgage in the Asia.

How to Use?

Earlier looking your perfect household, you’ll have an idea of just how much out-of property mortgage you would be qualified to receive centered on your revenue. It can help you in and also make a monetary view regarding the family you would want to to get. You can make use of the mortgage qualification calculator to decide how much currency you are eligible to. Since the property could have been accomplished, you may want to look at the HomeFirst web site and you may complete the latest inquiry function discover a visit back from of our own Counsellors. Look for this information for more information on loan conditions, otherwise this particular article to know about brand new papers needed for loan software.

To your a lot more than advice in hand, one can possibly clearly respond to the challenge out of exactly how much home loan one can acquire according to their money and take a huge action toward purchasing the dream house.