What is actually an effective Virtual assistant Cash-Out Re-finance?

Good Virtual assistant financial, as with any almost every other mortgage, would be refinanced. A beneficial Va home loan is eligible to own either a standard re-finance otherwise an effective “streamline” re-finance.

An effective Va streamline refinance, sometimes called mortgage Prevention Refinance loan, otherwise IRRRL, need zero appraisal and requirements restricted records about debtor. Zero earnings paperwork, a position confirmation or credit history is necessary, and that this new “streamline” label.

Exactly what in the event the debtor desires remove more dollars throughout the refinance? From the choosing a finances-aside refinance, the brand new improve choice goes away, but this 1 includes gurus.

Benefits associated with a funds-Out Re-finance

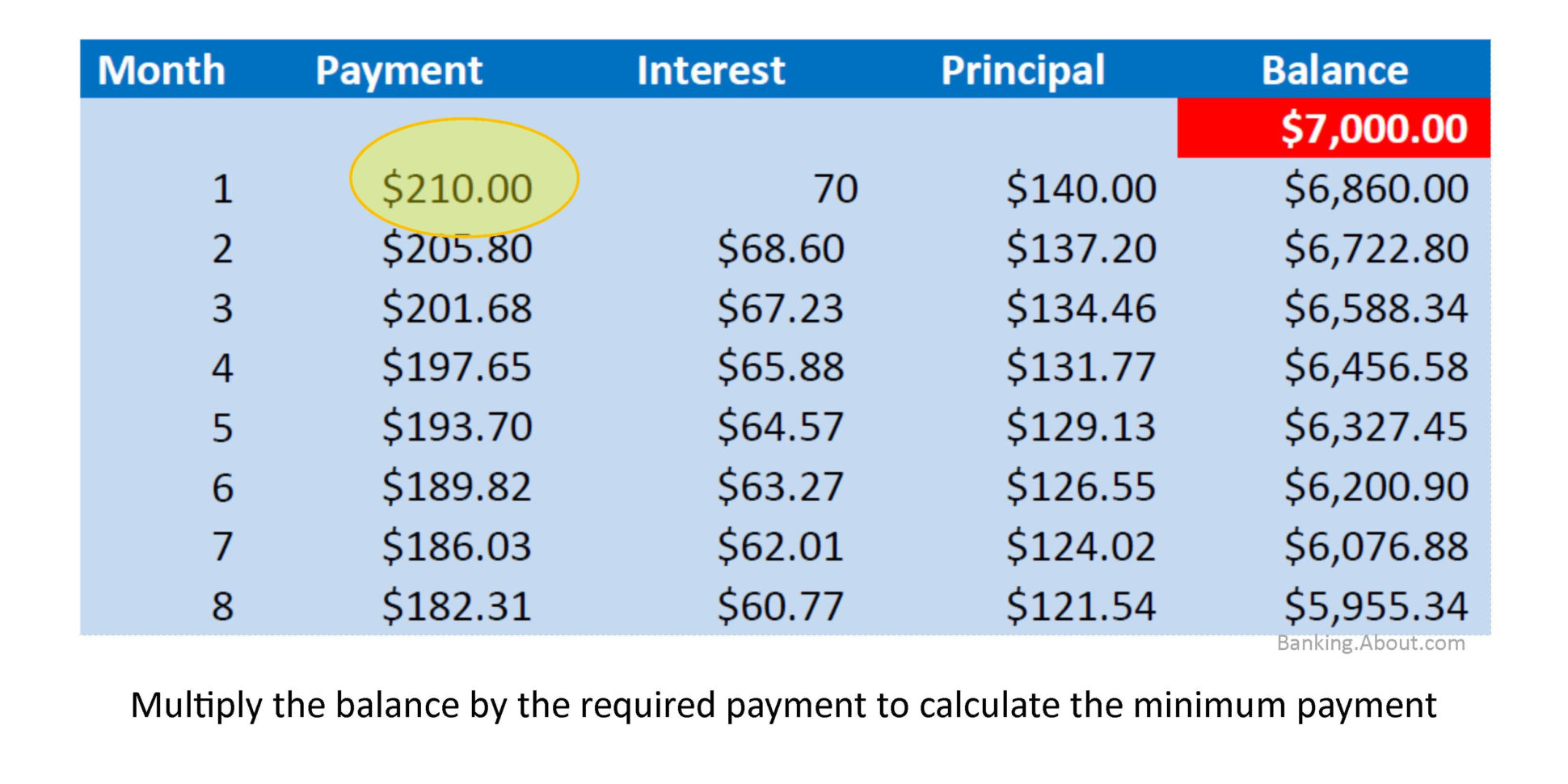

- Repay higher-notice obligations for example credit card debt

- Pay off liens

- Buy school

- Create home improvements

Va Bucks-Out Refinance loan Matter

The latest Virtual assistant does not have any an optimum loan amount, yet , has a maximum matter it does be sure. This guaranty are twenty-five% of the Va home loan is always to it go into standard.

Within the a profit-out refinance, the mortgage count was capped within 100% of property’s worth, considering yet another appraisal. However, whilst Va allows a cash-aside re-finance, this does not mean Va loan providers is going to do thus. Most Virtual assistant loan providers cap the utmost loan amount in the ninety% of property value the home.

As an example, let’s say a debtor enforce for good Virtual assistant mortgage and you can the appraised worth of was $three hundred,000. Maximum loan amount with respect to the VA’s laws and regulations would-be like the importance, $3 hundred,000. So if the current Va financial equilibrium try $200,000 and closing costs is $5,000, the money toward borrower is $three hundred,000 without $205,000, otherwise $95,000.

Va Dollars-Out Re-finance Income Criteria

Since Virtual assistant streamline refinance demands no money otherwise work papers, this new Va bucks-away mortgage necessitates the borrower to add proof of both. Which usually means that getting pay stubs for the most present 30-time months. Money have to be confirmed for everyone to the loan application.

The fresh borrower will also be expected to provide W-dos variations throughout the earlier in the day a couple of years. Of several Va lenders also inquire about copies of the most extremely previous 2 yrs away from government tax efficiency. The lender is needed to influence the borrower’s earnings was enough to safety brand new bucks-aside mortgage payments and additionally most other monthly payments, like vehicle, charge card or student loan repayments.

In lieu of the new Va improve refinance, the newest borrower’s credit report might be removed and you may assessed because of the Va financial evaluating brand new Virtual assistant cash-aside re-finance consult. Due to the fact Va doesn’t expose a minimum credit history, really loan providers wanted a minimum credit rating out-of 620. Yet not, lenders feel the directly to require a score off 680 or above.

Virtual assistant Lender Possessions Assessment

All the Virtual assistant cash-out fund require a full appraisal, once the limit loan amount will be based upon brand new house’s latest appraised well worth. Although debtor go for lower than a complete count. Because a beneficial Va dollars-aside mortgage is just as much as 100% of the worth of the house does not always mean brand new experienced is needed to undertake the utmost.

Try a funds-Out Re-finance wise?

Regarding an excellent Va dollars-out refinance mortgage, care and attention is going to be taken to ensure that the Va cash-aside program try a genuine benefit to new debtor. Just remember that , Va home loans need a financing percentage that can be around step three.15% of your amount borrowed, decreasing the web sum of money into debtor.

When you yourself have enough equity of your home, a cash-away mortgage underwritten so you’re able to old-fashioned criteria also have extra money so you’re loans in Comanche Creek able to your without the need for a funding payment.

Pros and cons away from an excellent Virtual assistant Dollars-Away Re-finance

- You can turn their residence’s equity towards the dollars.

- You e big date.

- You may be in a position to acquire the ability to repay a low-Virtual assistant loan when needed.

- You We).

- You will find limits into amount of liability brand new Va is also guess.

Make Second step

If you are willing to progress or want addiitional information, the first step is to get zero-responsibility price prices.