How do you go-about opting for an investment loan that will not end causing you financial discomfort? A house credit specialist sets within their a couple cents’ value throughout the how to choose best mortgage to you personally, together with secret issues to inquire about their lender.

Committing to possessions will be a lucrative promotion, it demands extreme financial resources, so if you’re given committing to home, getting a good investment financing provide the capital you should begin.

Although not, selecting the right mortgage for your investment property produces most of the the real difference with respect to building a profitable possessions profile.

To shop for a second home is a tiny different to buying your basic, once the there can be significantly more available regarding their method and you can expectations, says Bankwest Standard Movie director – Home buying, Peter Bouhlas.

With many loan options available, it can be daunting to learn where to start however, Peter claims starting the new groundwork to learn your financial situation is actually a good place.

Whether it is the first money spent or you are searching to add into portfolio, these represent the concerns to inquire of the financial in order to pick financing that is the right complement your financial requirements.

Exactly what are the current interest levels?

The rate commonly change the complete number you pay-off more the life of one’s financing, and it will somewhat impression your own profitability.

Interest levels having money funds are usually greater than men and women to possess owner-filled finance, nevertheless they can vary rather between lenders, making it necessary to contrast interest rates and you can look around getting an informed price.

Those trying buy accommodations possessions can find financial pros in performing this, but you can find you should make sure, for example what areas keeps higher tenant request, in addition to different interest levels readily available for dealers compared to holder-occupiers, Peter states.

When you yourself have several funds otherwise attributes, it could be useful contacting the lender otherwise broker, who can assist give an explanation for techniques and provide you with a notion away from exactly what your funds may look such immediately following.

Exactly what financing choices are offered?

Variable-rates finance have an interest rates that can change-over date, when you’re repaired-rate loans enjoys a-flat interest rate for a particular period.

Each kind away from mortgage has its advantages and disadvantages. Variable-price finance can provide autonomy and lower very first will cost you, whenever you are repaired-speed loans can provide defense and you may confidence when it comes to repayments.

For these provided repairing, Bankwest’s Fixed Price Financial comes with the certainty out-of being aware what the rate of interest and you can money was, Peter teaches you.

Home owners can pick their fixed rate period in one so you can five years, and you can installment volume, be one weekly, fortnightly or month-to-month, which can help somebody would their finances.

But before your augment, Peter says it’s worth taking into consideration new effects if you opt online installment loans New York to break the borrowed funds within the repaired months, given that break costs you’ll use.

Do you know the mortgage terms and conditions and features?

Other loan providers give other financing features that can apply to your own loan’s flexibility and you will overall cost, particularly offset profile, redraw organization, split financing and you will portability (the capacity to import your loan to a different property if you decide to promote an investment).

To help reduce your property loan focus, you may want to hook up a counterbalance account toward home loan or even be capable of making additional money, Peter claims.

Or, which will make dealing with your bank account and you can cost management much easier, you may choose so much more flexible repayment alternatives, the choice to split the loan ranging from repaired and adjustable, or to combine the money you owe to your mortgage.

If you’re refinancing to a new financial, you might like to be eligible to help you claim cashback now offers, that could help counterbalance any extra charges otherwise mortgage institution can cost you.

Exactly what are the payment possibilities?

An appeal-just loan would be an attractive selection for possessions dealers since the it allows to have straight down costs into the attention-merely period.

This will take back cashflow to own buyers to use for most other financial investments or perhaps to security property expenses instance repairs otherwise renovations.

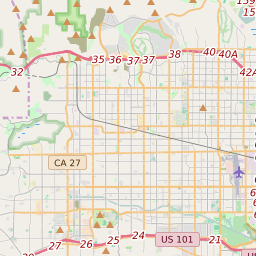

The fresh new fees solution you select will get a great deal to create together with your complete plan for forget the property. Picture: Getty

This can produce highest overall interest can cost you across the lifetime of your own financing, although the first costs was lower.

Any alternative costs can i consider?

It’s important to learn about the brand new initial will set you back that include to invest in an investment property as factoring within the will cost you outside of the deposit – such as for example bodies taxation – helps you end offensive shocks.

This can be your state otherwise region regulators income tax which is energized to have legal records to-be stamped. The fresh regulations into the stamp responsibility will always subject to changes, it is therefore a good idea to look at your county or area government’s construction website for the most present pointers.

Peter states those people thinking about to buy an alternative property possess novel factors, such as leverage brand new guarantee within their latest portfolio and you will refinancing the present funds.