step one. Initiate 1 year in advance of you will be wanting to pick a property. Get a cards medical exam through getting your myFICO rating.

dos. Try not to package one larger orders this current year. Never Make an application for or Open any the fresh handmade cards or loans. No The newest Autos.

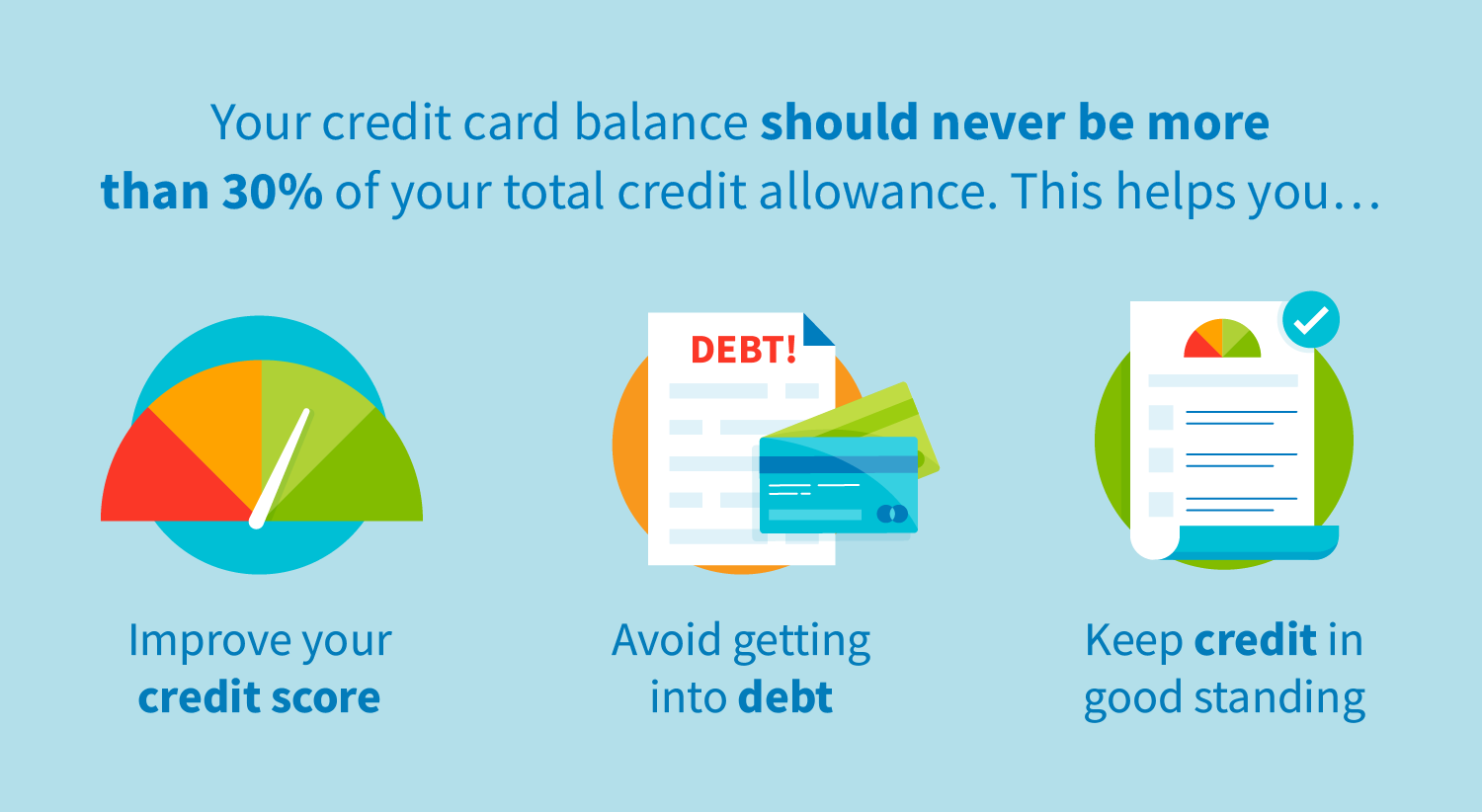

step three. Initiate repaying your own cards. See I did not state Pay-off, We said reduce. That leads us to my personal 2nd part.

Ask your Mortgage Administrator/Lender from the Va Loans

4. Initiate saving to own a deposit. You don’t have 20% off to possess property most of the time. However you will you need currency down. (Unless you’re an experienced. ) You can find mortgage software where you can get property having 3% down. Again, simply pose a question to your financial/loan manager about the subject. I understand some people try going to say buying home loan insurance policy is bad or a waste of money. But it really is not. You must know you to higher lump sum payment of money you only handed over since the a down payment. Essentially, many people usually do not thinking about staying in their very first house offered than simply 5 years. That it will not make sense so you’re able to eradicate all that cash to your your residence. Get LO crisis the fresh new amounts to see if it makes experience to save money thereon advance payment and sustain one to more funds on your own wallet having purchasing/wet months. Or if perhaps it’s better to place along the complete deposit to get loan application easy personal loan you into the forever home.

Become completely truthful on what you need out of your loan

5. Every person’s economic fingerprint varies and everybody has other specifications. You need to be upfront on what your finacial needs is actually for the 2nd 5 years and can help you determine what brand new best street is actually for you. Whenever they dont promote to do business with you can see the best services go someplace else.

six. Seek advice. Once they dont try select answers to the questions you have or extremely crappy on the after the right up – Work at Such as Tree GUMP and keep maintaining Running! You may be browsing has a bad big date within the entirety of the loan procedure. eight. In the event that shortly after half a year, you have a number of thousand in the financial and your borrowing from the bank score searching for a great, get a painful eliminate pre-qual. The hard eliminate won’t damage your own rating as you accompanied It will offer the difficult fast assistance you will need to pursue for another six months for the very best loan to possess you.

When you’re looking for a loan, I suggest you squeeze into a mortgage broker otherwise your own borrowing partnership. Quite often, a brokerage are able to find the most useful mortgage according to your own monetary profile and you can specifications. Brokers can comparison shop for a few lenders having an effective single borrowing pull. A card eliminate is perfect for 120 months, and you have 90 days discover a home and 29 days to close off.

You will want to query precisely what the total cost off financing try. There are lender charges and you will origination costs, and you may a lot of most other fees you to definitely specific banking companies and you may lenders fees consumers for and several lenders that do not. (Mod cut-and also this are poor advertising right here towards myFico) Be wary out-of brief shop lenders and you can large banks. I am not claiming they’re all of the bad. Only watch out for those charge. It might cost you or help save you a number of thousand bucks.

Lastly, Only a few Banking institutions And you will Lenders Are produced Equivalent. Get a hold of someone who try willing to spouse with you on this subject the fresh new and you may enjoyable thrill.

Something to recall when you ask locate pre-qual’d for a financial loan instead a difficult remove, they can not be certain that exactly what you’ll be able to be eligible for. These include while making a knowledgeable approximation in accordance with the affairs you have displayed all of them. Of numerous Loan Officers and Loan providers usually bashful away from having fun with credit ratings vocally told to them since most people imagine their borrowing from the bank is superior to it actually is. Don’t get too upset if the whatever they first told your try completely different than shortly after they will have removed the financing. There are just way too many points to to take into consideration, very rather than a great browse the money you owe they can not be yes.