The new Va resource percentage is a percentage of your own Virtual assistant financing count that is repaid in the closing. Which percentage is a lot like home loan insurance costs which might be reduced to other version of mortgage brokers, that will be paid-in change for the loan are supported by a government service. The latest Agencies off Veterans Facts (VA) partly claims a fraction of the loan, and that prompts loan providers so you can lend to those that might perhaps not otherwise be eligible for a traditional financial.

The Virtual assistant financial support percentage is just as high since step 3.6% of amount borrowed otherwise as little as 1.4%. The latest Va funding fee depends on how big is their down commission plus Va loan particular. Va cash-out refinancing funds have the same financial support payment regardless of downpayment.

In the event that newest Virtual assistant financing costs has dropped and you are clearly looking to help you refinance your existing Virtual assistant loan to the down rates, you will need to rating a good Va rate of interest avoidance refinance financing (IRRRL). IRRRLs features a beneficial Va funding payment off 0.5% of your own loan amount.

Va Native Western Lead Mortgage Money Percentage

Indigenous Western Head Fund (NADL) was to own characteristics with the federal believe land. That is an immediate home loan, and thus this new Service out of Veterans Things is your home loan financial.

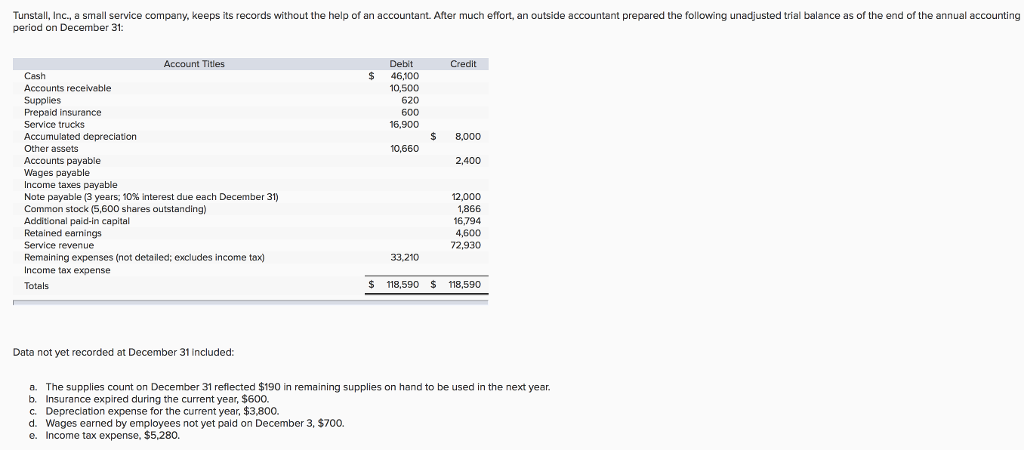

Ideas on how to Assess The Va Capital Commission

Make use of the Virtual assistant resource commission chart to find the relevant Va funding fee for your Va loan. Following put it to use up against your loan number.

Such as, you may be looking to purchase a good $five-hundred,000 home since an initial-go out home client. You are taking advantage of the point that Va financing haven’t any lowest down-payment requisite, and that means you make a great 0% down payment. The newest Va resource commission that applies to you’d be dos.3%.

dos.3% of one’s $five-hundred,000 Va financing try $eleven,500, which means your Virtual assistant money commission is actually $11,five hundred. Costs set in their home loan increase your mortgage’s Annual percentage rate, highlighting the higher total price of one’s financial. You can either spend it matter upfront inside the bucks, otherwise include it with the loan number. For people who add it to the loan, the Virtual assistant mortgage increase so you’re able to $511,five-hundred.

The fresh new Virtual assistant financing commission is billed during the closure. You may either spend the money for commission entirely or funds new payment adding they to the Va loan amount. By the addition of the newest Virtual assistant capital commission for the loan, you are going to slowly pay-off the price tag throughout your monthly home loan costs. While you are funding the fresh new resource percentage means you will never have to pay the payment immediately, including they toward financing means that appeal would be recharged towards financing commission.

Specific Virtual assistant mortgage brokers pays your installment loans online Florida own Va funding costs to own your in exchange for increased Virtual assistant home loan rate of interest.

- Youre already choosing, have obtained, or meet the criteria for Va impairment payments

- You are a partner regarding a veteran searching reliance and indemnity settlement (DIC) money

- Youre already on the active obligation and you will obtained the brand new Red Center

Attempt to give your own Virtual assistant mortgage lender your own Certification out of Qualification otherwise a Va investment payment exclusion form (Verification from Virtual assistant Gurus means).

While you are borrowing having a great co-candidate or a good co-debtor, this new Virtual assistant money percentage isnt completely waived if they are not exempt as well. Such as for example, when you are excused from the resource payment your co-applicant isnt, the new Va financing payment will be reduced because of the 1 / 2 of.

Effective services players having an excellent pending handicap allege commonly yet , excused in the financial support percentage up until the allege is eligible. Your exclusion should be confirmed prior to closure. For those who sign up for an effective Va financing having a pending disability allege, as with your exemption hasn’t started verified, you still have to pay on the Va investment payment. As soon as your allege is approved, you might contact your Virtual assistant Local Mortgage Cardio to get a great reimburse for the Virtual assistant investment commission percentage.

For people who financed the fresh money percentage by the addition of they to the amount borrowed, the latest refund have been in the type of a cards to help you the loan number.